Ray Dalio Net Worth, Wife, Education, House, Linkedin, Twitter and Age in 2025

As of February 2025, Ray Dalio net worth is estimated to be approximately $14 billion, according to Forbes. His wife, Barbara Dalio, has been by his side for many years, and they have several children together. Dalio attended Long Island University in New York, where he earned a Bachelor’s degree in Finance, and later went on to earn an MBA from Harvard Business School in 1975. Over the years, Dalio has owned several luxurious properties, with his primary residence located in Greenwich, Connecticut, where he lives with his wife. While he does not have a personal LinkedIn profile, Dalio is active on Twitter under the handle @RayDalio, where he shares his thoughts on economics, investing, global markets, and personal principles. Born on August 8, 1949, Dalio will turn 76 years old in 2025.

| Attribute | Details |

|---|---|

| Date of Birth | August 8, 1949 |

| Age | 76 years (as of 2025) |

| Birthplace | Jackson Heights, Queens, New York, USA |

| Residence | Greenwich, Connecticut, USA |

| Country | United States |

| Profession | Investor, Hedge Fund Manager, Author |

| Education | Long Island University (Bachelor’s in Finance), Harvard Business School (MBA) |

| Father | Irving Dalio (1st generation American, a jazz musician and musician’s agent) |

| Mother | Ruth Dalio (teacher) |

| Nationality | American |

| Siblings | 1 brother |

| Brother | 1 brother |

| Religion | Jewish (publicly identified) |

| Horoscope | Leo |

| Weight | Approximately 175 lbs (79 kg) |

| Height | 6 feet 2 inches (188 cm) |

| Net worth | Approximately $14 billion (2025) |

Ray Dalio Net Worth in 2025

As of February 2025, Ray Dalio’s estimated net worth is $14 billion, according to Forbes. This fortune is a direct result of his pioneering role in the hedge fund industry, particularly through his creation and leadership of Bridgewater Associates, one of the world’s largest and most successful hedge funds. Dalio’s wealth, while primarily tied to his firm, is also diversified through his investments, philanthropic contributions, and personal ventures.

Net Worth Overview

Dalio’s wealth management strategy revolves around his skill in navigating global financial markets, capitalizing on economic cycles, and emphasizing risk parity in his investment strategies. His estimated net worth of $14 billion reflects not only the continued success of Bridgewater Associates but also his other investments and assets. In addition to his hedge fund performance, Dalio has been involved in various business ventures, real estate investments, and public speaking engagements that have further contributed to his wealth. Through Bridgewater, Dalio has cultivated a reputation for delivering consistent returns, even in volatile market conditions. The firm manages over $112 billion in assets as of 2025, with Dalio himself holding a significant portion of its shares, securing his place as one of the wealthiest and most influential investors in the world.

Investment Success

Dalio’s success is largely attributable to his groundbreaking investment strategies, particularly his focus on global macro investing and risk parity. His flagship strategy, the Pure Alpha fund, uses a combination of assets to take advantage of global economic trends. This fund’s ability to produce returns during times of economic turbulence has been instrumental in Dalio’s rise to prominence. Bridgewater’s strategies are known for their diversification across asset classes and global markets, aiming to balance risks while maximizing returns over the long term.

Dalio’s investment philosophy is rooted in his book, Principles: Life and Work, where he outlines his approach to decision-making, risk, and management. His Pure Alpha strategy, in particular, has generated impressive returns, even during market downturns like the 2008 financial crisis, solidifying his reputation as a master of navigating turbulent financial landscapes. Furthermore, Dalio’s focus on diversification and non-correlated assets has allowed Bridgewater to maintain a competitive edge in the hedge fund industry, attracting institutional investors and preserving Dalio’s wealth.

Philanthropy

Beyond his financial achievements, Dalio is deeply involved in philanthropy, particularly through the Dalio Foundation, which supports a wide range of causes, including education, ocean exploration, public health, and economic development. His charitable giving has been substantial, with Dalio committing billions of dollars to causes that align with his values, such as bridging income inequality and promoting social justice. His philanthropic efforts enhance his reputation not only as a successful financier but also as a socially conscious investor.

Dalio’s philanthropic approach reflects his belief that wealth should be used to create positive change. His contributions to educational reform, including his funding for charter schools and initiatives aimed at improving access to quality education, highlight his commitment to addressing systemic issues in society. His financial philosophy also extends to his charitable giving, with Dalio focusing on long-term solutions rather than short-term fixes. This combination of business success and philanthropy has further elevated his financial profile, cementing his legacy as both an investor and a global influencer.

Other Assets

In addition to his hedge fund holdings, Ray Dalio owns significant real estate assets, including a luxury estate in Greenwich, Connecticut. This home is known for its privacy and seclusion, which suits Dalio’s preference for maintaining a low profile despite his public stature. Dalio has also made investments in various sectors, including private equity, and his interest in ocean exploration, environmental sustainability, and education have led him to support ventures in these areas.

Dalio diverse portfolio of investments, his leadership of Bridgewater, and his commitment to philanthropy all contribute to his current net worth and reputation. As he continues to focus on innovation and financial strategy, it is likely that Dalio’s wealth will remain robust in the years to come, solidifying his position as one of the most influential investors of his generation.

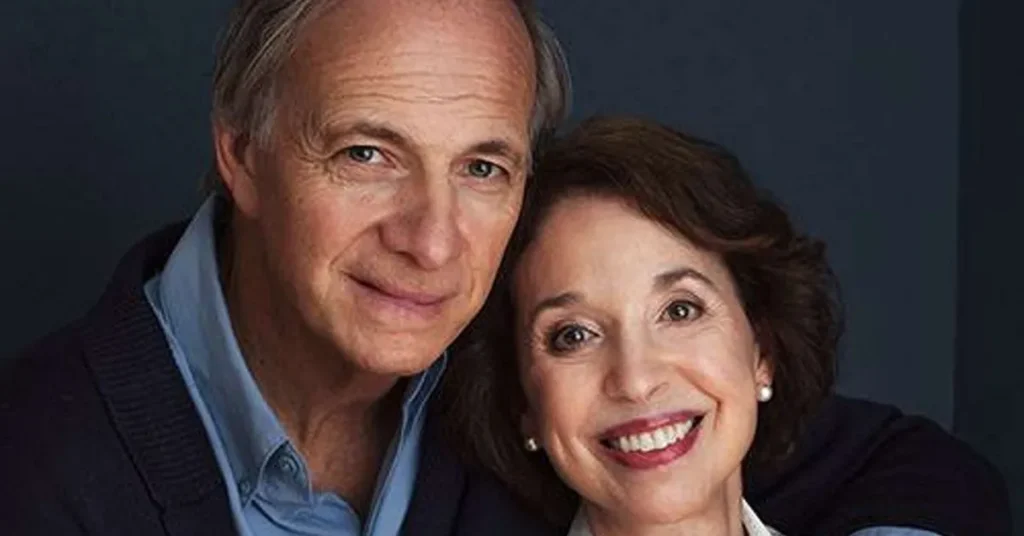

Ray Dalio Wife and Family

Ray Dalio’s personal life is intertwined with his professional success, particularly through his marriage to Barbara Dalio, his long-time wife and business partner. Together, they form a powerful duo both in their personal lives and in their commitment to charitable causes through the Dalio Foundation.

Who is Ray Dalio Wife?

Barbara Dalio has been a central figure in Ray Dalio’s life and career. While she tends to maintain a low public profile, Barbara is an integral part of the Dalio Foundation, where she works alongside Ray to drive philanthropic initiatives. The Dalio Foundation focuses on a wide range of causes, including education, ocean conservation, public health, and economic development. Both Ray and Barbara share a deep commitment to creating long-term positive change in society, which is reflected in their charitable endeavors.

Barbara is also deeply involved in the family’s philanthropic projects, such as the funding of charter schools and other education-related initiatives. She shares Ray’s belief in the importance of providing opportunities for growth and advancement in education and social equality. Although Barbara doesn’t hold the same public-facing role as Ray in the business world, her influence behind the scenes is substantial, particularly in shaping the family’s approach to giving back to society. The Dalios’ partnership in their charitable foundation serves as a testament to their shared values and vision for making a difference in the world.

Family Background

Ray and Barbara Dalio have been married for many years and have raised several children together. Their children are involved in various aspects of the Dalio family’s endeavors, including philanthropy and business. Some of their children are actively engaged in the Dalio Foundation, focusing on projects that aim to tackle pressing global issues. While Ray is often the public face of the family’s financial success, Barbara and their children play a critical role in continuing the Dalio legacy, particularly in their contributions to social causes and education.

The Dalio family has made a significant impact in various sectors, not just in finance but also in shaping educational reforms and contributing to environmental sustainability. The family’s deep involvement in philanthropy speaks to their shared values of responsibility, care for the community, and the desire to leave a lasting, positive impact on the world.

Personal Life

Ray Dalio and Barbara Dalio’s personal life is a blend of private family time and public philanthropic work. Despite Ray’s prominent role as one of the world’s most successful investors, the couple maintains a relatively low-key lifestyle, particularly when it comes to their personal matters. They reside in Greenwich, Connecticut, in a private estate, away from the media spotlight, reflecting Ray’s preference for seclusion and privacy.

Balancing his personal and professional life has always been a priority for Ray Dalio. He has often spoken about the importance of maintaining a work-life balance, despite the demands of running a major hedge fund like Bridgewater Associates. While Ray’s career has been incredibly consuming, he places a high value on spending quality time with his family, engaging in intellectual discussions, and supporting the family’s philanthropic efforts.

Ray Dalio Education and Early Career

Ray Dalio’s educational journey and early career laid the foundation for his later success as one of the most influential investors in the world. His academic background and early experiences helped shape his unique investment philosophy and approach to life.

Education Background

Dalio’s path to success began at Long Island University (LIU), where he earned a Bachelor’s degree in Finance. His time at LIU was pivotal in sparking his interest in financial markets, a field that would later become his life’s work. During his college years, Dalio developed a fascination with the stock market, and he would often study the movements of different companies, learning how to read market signals and analyze economic trends.

After completing his undergraduate studies, Dalio continued his education at Harvard Business School (HBS), where he earned his MBA in 1975. At Harvard, Dalio’s exposure to various business and economic theories deepened, and he was particularly influenced by his professors’ focus on decision-making and risk management. This academic experience allowed him to refine his thinking on markets and investing, providing him with the analytical tools he would later apply to create his own investment strategies.

Dalio’s time at HBS was crucial in shaping his investment approach. He was introduced to the idea of systematic, data-driven decision-making, a theme that would play a central role in his future success. It was during this period that Dalio began developing some of the core principles that would become the foundation of Bridgewater Associates, the hedge fund he would establish just a few years later.

Early Career

Dalio’s career in finance began after his graduation from Harvard Business School when he started his first job at Dominick & Dominick, a stock brokerage firm in New York. However, it was his next position, working at Merrill Lynch, where he truly gained hands-on experience in the financial industry. Dalio quickly developed a reputation for his ability to spot market trends and accurately predict economic movements.

In 1975, Dalio founded Bridgewater Associates out of his apartment. Initially, the firm was a consulting company, advising institutional clients on macroeconomic trends. Dalio’s ability to analyze global financial markets and forecast their movements attracted the attention of several influential investors, and over time, Bridgewater transitioned into a hedge fund. The firm’s distinctive Pure Alpha strategy, which combined macroeconomic analysis with diversified investments, would go on to become one of the most successful hedge fund strategies of all time.

Philosophy of Life and Investing

Dalio’s philosophy, both in life and investing, has become as famous as his financial acumen. He is known for his systematic and analytical approach to decision-making, which he describes in his bestselling book, Principles: Life and Work. In the book, Dalio outlines the guiding principles that have shaped his career, including his emphasis on radical transparency, idea meritocracy, and the importance of learning from mistakes. These principles became central to how he ran Bridgewater Associates and how he viewed both business and personal relationships.

One of the key elements of Dalio’s approach to investing is risk parity, which involves balancing risk across various asset classes to achieve optimal returns. His belief in the importance of diversification and managing risk, combined with a commitment to constant learning, allowed Bridgewater to thrive even in turbulent market conditions. Dalio’s approach to life is similarly methodical, with an emphasis on self-reflection and continuous improvement. His personal principles are grounded in the idea that failure is a learning opportunity and that understanding one’s weaknesses is essential for growth.

Related Posts:

Ray Dalio House and Real Estate

Ray Dalio is not only known for his financial acumen but also for his impressive real estate holdings, which reflect his success and lifestyle. His properties are an extension of his personal philosophy of privacy, luxury, and strategic investments. As one of the wealthiest individuals in the world, Dalio’s real estate portfolio spans multiple regions, with his primary residence being a luxurious mansion in Greenwich, Connecticut. However, his investments go beyond residential properties and extend into strategic real estate ventures, further solidifying his standing in the world of high-end assets.

Properties Owned by Ray Dalio

Dalio’s most notable property is his Greenwich estate, a sprawling and private mansion located in one of the wealthiest communities in the United States. The property is known for its luxurious features, including vast grounds, expansive gardens, and a sense of seclusion that offers Dalio and his family a peaceful retreat away from the public eye. The mansion reflects Dalio’s preference for privacy and tranquility, allowing him to maintain a low-key lifestyle despite his immense public wealth. The Greenwich estate is estimated to be worth tens of millions of dollars, adding significantly to Dalio’s overall net worth.

In addition to his primary residence, Dalio has been linked to several other luxury properties, including a New York City apartment and vacation homes in Florida. These properties offer him a range of living environments, from the quiet seclusion of Connecticut to the bustling energy of the city and the sunny retreats of the South. While Dalio is generally known to avoid flaunting his wealth, these properties serve as a testament to his financial success, each chosen for its blend of luxury, privacy, and location.

Real Estate Investments

Beyond residential properties, Dalio has also made significant investments in the real estate sector. Bridgewater Associates, the hedge fund he founded, has historically invested in real estate, taking advantage of market fluctuations and economic cycles to acquire both commercial and residential properties. Dalio’s investment philosophy in real estate mirrors his approach to other asset classes: a focus on diversification and long-term value rather than short-term gains.

Dalio has been involved in several major real estate deals, particularly those that align with his global macroeconomic strategies. His approach to property investments often emphasizes purchasing assets in areas with high growth potential or those that offer long-term stability. Additionally, Dalio’s belief in diversification across various markets has led him to invest in real estate internationally, ensuring that his property portfolio is balanced and resilient against regional economic downturns. While specific details about all of his real estate transactions are not widely publicized, Dalio’s strategic mindset has been evident in his consistent ability to identify lucrative opportunities in this sector.

Lifestyle and Luxury

Dalio’s residences offer a glimpse into his luxurious lifestyle, with an emphasis on privacy, comfort, and understated opulence. His Greenwich mansion, for example, provides a peaceful, private environment, which is a stark contrast to the high-paced, public nature of his financial career. This balance between seclusion and luxury is a hallmark of Dalio’s approach to life. His homes are equipped with high-end amenities and offer plenty of space for both personal relaxation and hosting intimate gatherings. Despite his wealth, Dalio has been known to avoid the public eye, and his homes reflect his preference for discretion rather than excessive display.

Ray Dalio’s LinkedIn and Twitter

Ray Dalio’s use of social media reflects his commitment to sharing his thoughts on economics, finance, and life, providing insights that resonate with both financial professionals and the broader public. Although Dalio does not have a personal LinkedIn profile, he maintains a professional presence on the platform through his Bridgewater Associates page and posts from his team. However, it is Twitter where Dalio is most active in engaging with his audience.

LinkedIn Presence

Dalio’s LinkedIn presence is more business-focused, and while he is not personally managing a profile, his firm and other professional channels act as a conduit for sharing his perspectives. On LinkedIn, Dalio shares articles, insights on global economic trends, and commentary on his principles that guide both life and work. Bridgewater Associates also posts content that reflects Dalio’s principles of radical transparency, idea meritocracy, and investment strategies. With over 100,000 followers on LinkedIn, Dalio’s professional voice influences a large audience, particularly those in the finance, business, and academic sectors.

Through his posts, Dalio has successfully cultivated an audience that values his deep understanding of financial markets and macroeconomic shifts. By regularly sharing his thought leadership and updating followers on his latest ideas and publications, he maintains a strong online presence while engaging with individuals who are eager to learn from his experience.

Twitter Activity

Dalio is very active on Twitter, where he has a much more personal and direct presence with his followers. His Twitter handle, @RayDalio, has over 2 million followers as of 2025, making him one of the most influential voices on the platform when it comes to economic commentary and financial advice. On Twitter, Dalio shares a wide range of content, from observations on global economic trends to reflections on his personal life principles. He often posts data-driven insights, along with his views on the future of markets, investing strategies, and economic cycles.

Dalio’s Twitter activity extends beyond mere commentary; he also participates in conversations, answering questions and engaging with his audience. This interaction allows him to directly influence his followers, especially those looking for guidance on investment strategies or macroeconomic analysis. He is known for sharing excerpts from his book “Principles”, offering his followers access to the wisdom that has guided his career and personal life.

Social Media Strategy

Dalio social media strategy is centered on authenticity and education. Unlike many of his peers in finance, Dalio does not use social media to promote his wealth or personal brand; instead, he focuses on sharing valuable information and insights that can help others understand complex financial systems and make better decisions. His approach helps him maintain relevance in the digital age, where thought leaders can easily connect with audiences through platforms like Twitter.

Dalio social media presence allows him to reach a broader audience beyond just institutional investors, fostering engagement with everyday people who are interested in finance, economics, and self-improvement. By maintaining a consistent and thoughtful presence, Dalio ensures that he remains at the forefront of discussions on global economic issues, all while adhering to his principles of transparency and truth-seeking.

Ray Dalio Age and Personal Reflections in 2025

Age in 2025

In 2025, Ray Dalio will be 76 years old, marking more than four decades of groundbreaking work in the world of finance. Over the course of his career, Dalio has become one of the most influential figures in the global financial sector. As the founder of Bridgewater Associates, he built the firm into one of the world’s largest and most successful hedge funds. His contributions to finance, particularly in macroeconomic analysis, risk management, and investment strategies, have solidified his reputation as a visionary in the industry.

Dalio’s accomplishments go beyond finance, with his insights on leadership, decision-making, and personal development helping shape the corporate world. His book Principles has been widely read and praised for its practical approach to life and work, influencing countless individuals and organizations.

Reflections on Life

As Dalio approaches his later years, his reflections on life have grown more introspective. He has spoken frequently about the importance of radical transparency and continuous learning, both in business and in personal life. In interviews and his writings, Dalio often shares that one of his biggest takeaways from his career is the value of embracing mistakes and learning from them. He believes that true success comes from being open to new ideas, constantly evolving, and seeking out feedback. His focus on personal growth and self-reflection continues to resonate with many, particularly younger generations of professionals.

Future Outlook

Looking ahead, Dalio’s future plans likely include continued involvement in philanthropy through the Dalio Foundation, where he has worked to address critical issues in education, ocean conservation, and economic development. While it is unclear whether Dalio will fully retire from Bridgewater Associates, he has expressed interest in mentoring the next generation of leaders and thinkers. Personally, he may also continue to reflect and share his life lessons, perhaps through additional writings or speaking engagements, as his wealth of knowledge and experience remains invaluable to those navigating complex global systems.

frequently asked questions

What is Ray Dalio net worth in 2025?

Ray Dalio net worth is estimated to be approximately $14 billion in 2025, according to Forbes. His wealth primarily stems from his role as the founder of Bridgewater Associates, one of the world’s largest hedge funds.

How old is Ray Dalio in 2025?

Ray Dalio will be 76 years old in 2025, having been born on August 8, 1949.

What is Ray Dalio educational background?

Dalio earned his Bachelor’s degree in Finance from Long Island University and went on to receive an MBA from Harvard Business School in 1975, which laid the foundation for his successful career in finance.

What are Ray Dalio key principles?

Ray Dalio is widely known for his philosophy of radical transparency and his principles on decision-making, which he outlines in his bestselling book Principles. His approach focuses on meritocracy, learning from mistakes, and embracing transparency within organizations.

What is Ray Dalio primary residence?

Dalio’s primary residence is located in Greenwich, Connecticut, where he owns a luxurious mansion that provides privacy and a serene environment for him and his family.

What is Ray Dalio involvement in philanthropy?

Dalio is heavily involved in philanthropy, primarily through his Dalio Foundation, which supports causes related to education, ocean conservation, and economic development. He has committed to giving away a significant portion of his wealth to address global challenges.

What social media platforms does Ray Dalio use?

Ray Dalio is active on Twitter, where he shares insights on economics, investing, and personal principles. He does not maintain a personal LinkedIn profile but his firm, Bridgewater Associates, shares his professional insights on that platform.

What is Ray Dalio approach to investing?

Dalio is known for his risk parity strategy, where he focuses on balancing risks across various asset classes to ensure optimal returns. His investment philosophy also emphasizes diversification, data-driven decision-making, and a deep understanding of global macroeconomic trends.

What are Ray Dalio’s family details?

Ray Dalio is married to Barbara Dalio, and they have several children together. The Dalio family is also actively involved in their philanthropic initiatives through the Dalio Foundation.

What is Ray Dalio’s legacy in finance?

Dalio’s legacy in finance is largely built on his innovative approaches to investing and his role in establishing Bridgewater Associates as one of the most successful hedge funds globally. His investment strategies, particularly Pure Alpha, have reshaped the hedge fund industry and continue to influence investors worldwide.

Conclusion

Ray Dalio has solidified his place as one of the most influential figures in the world of finance. As the founder of Bridgewater Associates, his innovative investment strategies and groundbreaking approaches to macroeconomic analysis have reshaped the hedge fund industry. By 2025, Dalio’s net worth is estimated at $14 billion, and his legacy in finance continues to thrive through his leadership at Bridgewater and his contributions to financial theory. Beyond his professional success, Dalio’s commitment to philanthropy through the Dalio Foundation highlights his deep concern for addressing critical global challenges in areas like education and ocean conservation.